Get a Great Mortgage Rate

Discover Your Mortgage Qualification Instantly with Our Free Tools!

Get a Great Mortgage Rate

Discover Your Mortgage Qualification Instantly with Our Free Tools!

Best Mortgage Lending Services In Michigan

At Michigan Mortgage Solutions, we are committed to guiding you through the home financing process with transparency and ease. As a leading mortgage broker in Michigan, we specialize in providing customized mortgage solutions that meet your unique needs. Whether you're a first-time homebuyer or looking to refinance, our team is here to help you secure the best terms and lowest rates possible.

Best Mortgage Lending Services In Michigan

At Michigan Mortgage Solutions, we are committed to guiding you through the home financing process with transparency and ease. As a leading mortgage broker in Michigan, we specialize in providing customized mortgage solutions that meet your unique needs. Whether you're a first-time homebuyer or looking to refinance, our team is here to help you secure the best terms and lowest rates possible.

What Sets Michigan Mortgage Solutions Apart?

At Michigan Mortgage Solutions, we believe in empowering our clients through education. We demystify the mortgage process, ensuring you comprehend every step and make informed decisions. Our aim is to minimize your out-of-pocket expenses while optimizing the mortgage program tailored to your needs.

Serving Borrowers' Needs

For borrowers seeking the best mortgage programs, we understand your challenges. From securing the lowest rates to tailoring terms that meet your financial goals, we’re dedicated to finding the right solution for you. Our programs are designed to reduce financial strain and maximize benefits, ensuring a smooth homeownership journey.

Take The Next Step

Ready to explore your mortgage options? Schedule a Consultation with us today and let’s start building your future.

What Sets Michigan Mortgage Solutions Apart?

At Michigan Mortgage Solutions, we believe in empowering our clients through education. We demystify the mortgage process, ensuring you comprehend every step and make informed decisions. Our aim is to minimize your out-of-pocket expenses while optimizing the mortgage program tailored to your needs.

Serving Borrowers' Needs

For borrowers seeking the best mortgage programs, we understand your challenges. From securing the lowest rates to tailoring terms that meet your financial goals, we’re dedicated to finding the right solution for you. Our programs are designed to reduce financial strain and maximize benefits, ensuring a smooth homeownership journey.

Take The Next Step

Ready to explore your mortgage options? Schedule a Consultation with us today and let’s start building your future.

Recent Mortgage Lending

Mortgage Lending FAQ's

Frequently Asked Questions About Mortgage Lending & Loan Programs

Question 1: What types of mortgage loan programs does Michigan Mortgage Solutions offer?

Michigan Mortgage Solutions offers a variety of mortgage loan programs, including Conventional mortgages, FHA loans, USDA loans, VA loans, first-time home buyer programs, cash-out refinances, and low-rate refinances. Our experienced team can help you find the best option tailored to your financial situation and goals.

Question 2: What is the process to apply for a mortgage loan at Michigan Mortgage Solutions?

To apply for a mortgage loan, simply click the "Apply Now" button at the top of the page and fill out our secure online application form, which helps us gather your financial and personal details. Our mortgage experts will then review your application and guide you through the next steps to secure the best loan options available in Michigan.

Question 3: How can first-time home buyers benefit from your services?

First-time home buyers can benefit from our specialized programs that provide competitive rates and terms, along with guidance through the complex home-buying process. We work closely with you to secure the most favorable loan conditions and ensure a smooth home ownership experience.

Question 4: What are the best loan options for first-time home buyers in Michigan?

For first-time home buyers in Michigan, we offer FHA, USDA, and VA loan programs that require low down payments. These programs are tailored to help you minimize out-of-pocket costs and secure the lowest monthly payments.

Question 5: What is the process for getting a zero down mortgage in Michigan?

To get a zero down mortgage in Michigan, consider USDA or VA loans. These options often provide 100% financing to eligible home buyers, minimizing initial costs and focusing on affordability. Our mortgage brokers are experts in securing these types of loans.

Question 6: How can I qualify for down payment assistance programs?

Qualifying for down payment assistance in Michigan usually requires meeting specific income and credit score criteria. Our team at Michigan Mortgage Solutions can guide you through the requirements and help you find the best program for your situation.

Question 7: Can Michigan Mortgage Solutions help if I have a low credit score?

Yes, Michigan Mortgage Solutions offers programs specifically designed for buyers with a lower credit score. Our FHA programs are particularly beneficial, providing competitive rates even if your credit needs improvement.

Question 8: Can military veterans access VA home loans through your company?

Yes, Michigan Mortgage Solutions proudly supports military veterans by offering VA home loans. These loans feature benefits like no down payment and favorable terms, recognizing the service of our veterans. Our experts are dedicated to simplifying the process for you.

Question 9: What advantages do FHA loan programs provide to Michigan residents?

FHA loan programs offer lower down payment requirements and flexible credit qualifications, making them ideal for Michigan residents who may face challenges with traditional lending criteria. Our team helps you navigate the FHA loan system to maximize these advantages.

Question 10: Are there low-rate refinance options available, and how do they benefit homeowners?

Yes, we offer low-rate refinance options designed to reduce your monthly mortgage payments and overall interest costs. These refinances provide potential savings and financial relief, allowing homeowners in Michigan to manage their finances more effectively.

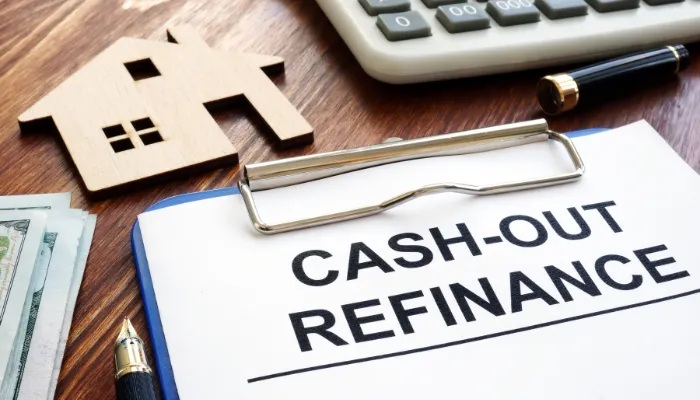

Question 11: How does Michigan Mortgage Solutions assist homeowners with cash-out refinance?

We assist homeowners by offering cash-out refinance options that enable them to tap into their home equity at competitive rates. Whether you're looking to pay off debt or invest in home improvements, our team ensures you get the most benefit from your refinance.

Question 12: Are there advantages to working with a mortgage broker versus a bank in Michigan?

Yes, a mortgage broker like Michigan Mortgage Solutions offers tailored mortgage solutions from various lenders, unlike banks that offer their own products. This flexibility helps us find the most beneficial terms and rates for you.

Mortgage Lending FAQ's

Frequently Asked Questions About Mortgage Lending & Loan Programs

Question 1: What types of mortgage loan programs does Michigan Mortgage Solutions offer?

Michigan Mortgage Solutions offers a variety of mortgage loan programs, including Conventional mortgages, FHA loans, USDA loans, VA loans, first-time home buyer programs, cash-out refinances, and low-rate refinances. Our experienced team can help you find the best option tailored to your financial situation and goals.

Question 2: What is the process to apply for a mortgage loan at Michigan Mortgage Solutions?

To apply for a mortgage loan, simply click the "Apply Now" button at the top of the page and fill out our secure online application form, which helps us gather your financial and personal details. Our mortgage experts will then review your application and guide you through the next steps to secure the best loan options available in Michigan.

Question 3: How can first-time home buyers benefit from your services?

First-time home buyers can benefit from our specialized programs that provide competitive rates and terms, along with guidance through the complex home-buying process. We work closely with you to secure the most favorable loan conditions and ensure a smooth home ownership experience.

Question 4: What are the best loan options for first-time home buyers in Michigan?

For first-time home buyers in Michigan, we offer FHA, USDA, and VA loan programs that require low down payments. These programs are tailored to help you minimize out-of-pocket costs and secure the lowest monthly payments.

Question 5: What is the process for getting a zero down mortgage in Michigan?

To get a zero down mortgage in Michigan, consider USDA or VA loans. These options often provide 100% financing to eligible home buyers, minimizing initial costs and focusing on affordability. Our mortgage brokers are experts in securing these types of loans.

Question 6: How can I qualify for down payment assistance programs?

Qualifying for down payment assistance in Michigan usually requires meeting specific income and credit score criteria. Our team at Michigan Mortgage Solutions can guide you through the requirements and help you find the best program for your situation.

Question 7: Can Michigan Mortgage Solutions help if I have a low credit score?

Yes, Michigan Mortgage Solutions offers programs specifically designed for buyers with a lower credit score. Our FHA programs are particularly beneficial, providing competitive rates even if your credit needs improvement.

Question 8: Can military veterans access VA home loans through your company?

Yes, Michigan Mortgage Solutions proudly supports military veterans by offering VA home loans. These loans feature benefits like no down payment and favorable terms, recognizing the service of our veterans. Our experts are dedicated to simplifying the process for you.

Question 9: What advantages do FHA loan programs provide to Michigan residents?

FHA loan programs offer lower down payment requirements and flexible credit qualifications, making them ideal for Michigan residents who may face challenges with traditional lending criteria. Our team helps you navigate the FHA loan system to maximize these advantages.

Question 10: Are there low-rate refinance options available, and how do they benefit homeowners?

Yes, we offer low-rate refinance options designed to reduce your monthly mortgage payments and overall interest costs. These refinances provide potential savings and financial relief, allowing homeowners in Michigan to manage their finances more effectively.

Question 11: How does Michigan Mortgage Solutions assist homeowners with cash-out refinance?

We assist homeowners by offering cash-out refinance options that enable them to tap into their home equity at competitive rates. Whether you're looking to pay off debt or invest in home improvements, our team ensures you get the most benefit from your refinance.

Question 12: Are there advantages to working with a mortgage broker versus a bank in Michigan?

Yes, a mortgage broker like Michigan Mortgage Solutions offers tailored mortgage solutions from various lenders, unlike banks that offer their own products. This flexibility helps us find the most beneficial terms and rates for you.

Contact Us

Service Hours

Social Media

Monday - Friday: 9:00 AM - 6:00 PM

Saturday: 9:00 AM - 12:00 PM

Sunday: Closed

More Locations We Serve

All Rights Reserved Corporate NMLS 136972

Contact Us

(248) 963-1894

35 W Huron St #301

Pontiac, MI 48342

Service Hours

Monday - Friday: 9:00 AM - 6:00 PM

Saturday: 9:00 AM - 12:00 PM

Sunday: Closed

Social Media